Green certifications are becoming part of the construction process

We continue to present the activities of the Savills office in Prague. This time, we are introducing the Building & Project Consultancy Department which provides construction consultancy and project management services for investors and occupiers of all sectors of real estate in Central Europe.

The Building & Project Consultancy department of Savills CZ has six members who work under the leadership of Jan Jurčíček, Head of BPC. He answered our questions together with Barbora Jansová, ESG Consultant and Project Manager.

The Savills Building & Project Consultancy department has a relatively wide range of activities. Could you introduce them, please?

Jurčíček: Our department started building services on transactional technical consulting, that is technical audits aimed at identifying risks arising from real estate’s technical condition during transactions (technical due diligence). We not only examine the current state of the property or prepare a plan for the necessary capital investments in a horizon of for instance 10 years, but we also check the issued permits, proprietary relationships and the state of the technical documentation related to the building. This requires extensive experience with the process, for instance in aspects of cooperation with legal and commercial consultants. Other pillars that we have gradually started to add are project management, project monitoring especially for banking institutions, consulting in the field of sustainability and, of course, specific technical consulting and the preparation of feasibility studies based on the specific needs of our clients, which include investment groups, funds, multinational clients, developers, banking institutions, but also private individuals. The area of sustainability and ESG is a relatively new segment for us. We began to pay more attention to it in 2021, and with the recent arrival of Bára Jansová, this sector becomes even more important for Savills, as we want to expand our portfolio of services with detailed ESG assessments.

Jurčíček: Our department started building services on transactional technical consulting, that is technical audits aimed at identifying risks arising from real estate’s technical condition during transactions (technical due diligence). We not only examine the current state of the property or prepare a plan for the necessary capital investments in a horizon of for instance 10 years, but we also check the issued permits, proprietary relationships and the state of the technical documentation related to the building. This requires extensive experience with the process, for instance in aspects of cooperation with legal and commercial consultants. Other pillars that we have gradually started to add are project management, project monitoring especially for banking institutions, consulting in the field of sustainability and, of course, specific technical consulting and the preparation of feasibility studies based on the specific needs of our clients, which include investment groups, funds, multinational clients, developers, banking institutions, but also private individuals. The area of sustainability and ESG is a relatively new segment for us. We began to pay more attention to it in 2021, and with the recent arrival of Bára Jansová, this sector becomes even more important for Savills, as we want to expand our portfolio of services with detailed ESG assessments.

What do you consider to be the key activity? Or do all of them have the same importance?

Jurčíček: They all are not of the same importance. For me personally, the closest are the already mentioned technical audits, which I have attended to for over 10 years, and which have, for several years, formed the core of our activities. We are now doing well in diversifying services. Project management is very much on the rise – both in the case of commercial constructions and industrial buildings – and so is project monitoring for our clients. The spectrum of services is now spread out in a healthy way, which allows us to respond better to recent market fluctuations or even those that may emerge with persistent inflation and highly compressed transaction yields.

There are traditional activities, such as project management, but also ‘modern’ activities, including green certification or the more and more frequently mentioned ESG. What does ESG actually entail?

Jurčíček: I would like to say that ESG is not a new term. I see this area as a new approach to the overall evaluation of company processes – and in our segment also to the impact the construction and operation of commercial real estate have in several areas that were previously evaluated separately and without wider context.

Jansová: As Honza mentions above, ESG is basically a new name and concept for already existing initiatives and processes. At Savills, we see this as an opportunity to help our clients evaluate possible ESG risks in time, whether within the framework of individual buildings or the entire portfolio, set long-term ESG strategies, and help with the preparation of comprehensive and transparent reporting due to the growing requirements of ESG legislation and various ESG standards and principles. We believe that responsible investing or consideration of environmental, social and governance or corporate criteria (ESG) brings a long-term competitive position in the market, financial results and a positive social impact. Since we have many years of experience with green certifications and other green services, we are able to provide our clients with comprehensive advice that takes into account not only ESG but also other aspects in the field of sustainability.

Can you describe a specific project or situation?

Jurčíček: One of the main drivers is the financing of commercial projects. Retail investors and banks are increasingly aware and set incentives for financing sustainable projects, and that is why they use ESG metrics that derive from European legislation. A particular example is the situation of not only large players in the real estate market, who aim for preferential financing, and therefore implement green certification processes more often already in the construction process, not only as an evaluation of existing buildings, furthermore, it is an increased emphasis on operational savings forced by rising energy prices and pressure from tenants, who gradually refuse to rent uncertified, uneconomic premises with a high carbon footprint. All of these factors necessitate investment in optimising building envelopes, efficiency of heat and cold source technologies and considering other options such as photovoltaics.

You are active in various segments of property development – from residential to retail, from hotels and offices to industrial and logistics real estate. Which part do you focus on the most and in what respect?

Jurčíček: You are right, we operate in all sectors, however, our focus is based on the most active sectors in the market, which are still offices and industrial real estate. The industrial real estate sector is, since Covid era, experiencing steeper growth than before and offices still represent a traditional target for our clients’ investments, just like in the neighbouring countries. The retail sector in the Czech Republic is relatively highly consolidated, which limits the demand for consultancy services, but the residential sector, for instance, is increasingly active and we manage to use partnership cooperation with Lexxus there.

Do you have a ‘flagship’ project, that is a project on which you have applied multiple activities?

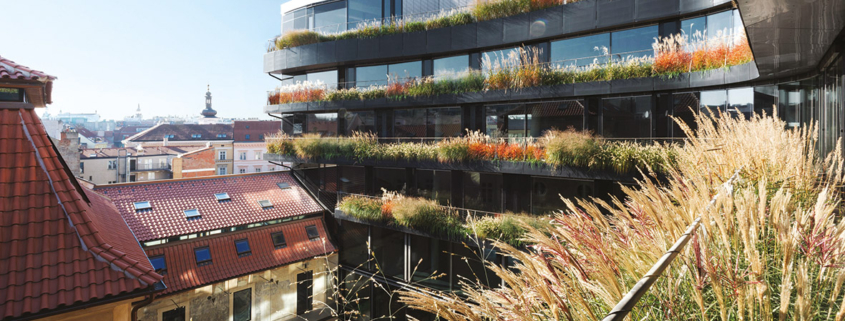

Jurčíček: The DRN building is an ideal example. Four years ago, I led a technical team in the acquisition of the building. Savills now manages the building, leases it and our team now conducts an overall in-depth technical audit in order to identify warranty defects. DRN building has recently achieved Excellent rating in Asset Performance according to BREEAM In-Use v6 and Savills acted as an Assessor Company on this project supporting the Client in all aspects of the certification process. We also continue further discussions with the client to assess the ESG impacts of the building operation. It is a unique project in the Prague market and the building is also exceptional for the whole Savills team. We are very grateful to our client that he has entrusted us with the overall care of this building and that we can prepare such an extensive and comprehensive package of services for him.